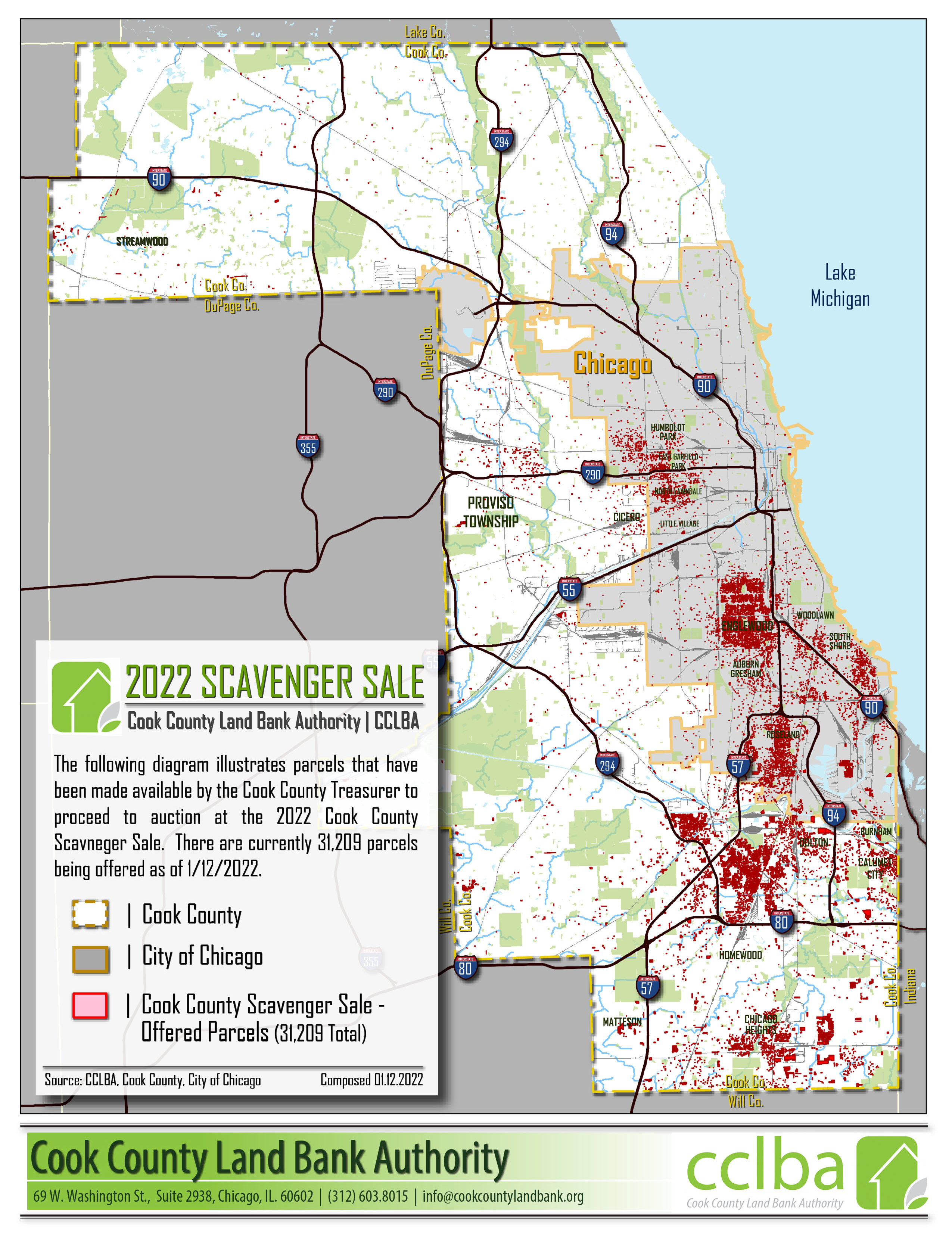

2022 SCAVENGER SALE – UPDATED 4/20/2022

The Cook County Land Bank Authority participated in the 2022 Cook County Scavenger Sale, which was conducted from February 14th – March 3rd, 2022. Out of the 31,209 parcels originally offered by the Cook County Treasurer, data obtained by Chicago Cityscape found that 5,180 properties were bid on by the private market. Additionally, the Cook County Bureau of Economic Development(CCBED) successfully bid on 505 parcels, and the Cook County Land Bank Authority (CCLBA) successfully bid on 1,951 parcels.

A full list of the 1,951 PINS the CCLBA bid on at the sale, as well as the rationale for why these properties were bid on by the CCLBA, are noted in the spreadsheet below. Please click on the spreadsheet below to view all parcels. The CCLBA has also made these PINs available for viewing on our Interactive Property Portal, which you can find by clicking here and navigating to the, ‘2022 Scavenger Sale – CCLBA Tax Certificates Bids’ layer. Please note that it takes 1-3 years to take these tax certificates to deed and at that point, these parcels will be advertised for public sale on the CCLBA sale portal.

![]() CLICK HERE FOR ALL COOK COUNTY LAND BANK AUTHORITY SCAV SALE BIDS

CLICK HERE FOR ALL COOK COUNTY LAND BANK AUTHORITY SCAV SALE BIDS

OBJECTIVE

The central mission of the CCLBA lies in identifying vacant & abandoned properties throughout Cook County, and putting those properties back into productive use. In an attempt to revitalize and effectively reboot distressed neighborhoods, the Land Bank is making available properties that have been tax delinquent for a number of years. These parcels have essentially been abandoned and have long been eyesores to their respective community. What’s more, these parcels are near impossible to redevelop given the back taxes and fines imposed on the property that more often than not exceed the value of the property itself.

Through this program, the Land Bank as a municipal agency is looking to effectively level the playing field in these communities and extinguish the outstanding tax amount so that an individual or organization who has a plan for putting these properties back into productive use has a clear path to do so. The Land Bank does not currently own these properties, however we have the option to acquire the property provided that there’s a viable and sustainable plan that benefits the community as a whole. Through these efforts, the CCLBA is aspiring for a neighborhood reboot in an effort to revitalize and restore our neighborhoods and municipalities.

SCAVENGER SALE – CCLBA’S INVOLVEMENT

The CCLBA participated in the 2015, 2017, 2019 and 2022 Cook County Scavenger Sales. Many of these parcels were products of the 2008 financial crisis. The Land Bank successfully acquired 26,520 tax certificates at the 2015, 2017, and 2019 Scavenger Sales. These properties/parcels were selected due to the fact that they were located in our focus communities (an outline of the CCLBA’s focus community strategy can be found here) as well as parcels located in census tracts within our target areas. Shown to the right is a diagram of what the CCLBA successfully bid on at the 2015 Scavenger Sale, and can be found in an interactive format located here.

These certificates were under the assumption that these parcels were abandoned, and therefore unoccupied. The Land Bank is NOT interested in acquiring parcels that are occupied.

COOK COUNTY SCAVENGER SALE

COOK COUNTY SCAVENGER SALE

On an annual basis, Cook County has a number of parcels where the taxes are delinquent. When that happens, the unpaid taxes on these parcels are offered at an annual tax sale, where the general public has the option to buy those unpaid taxes in the form of a certificate. This certificate does not give the ownership to the tax buyer, but it provides the option for the tax buyer to obtain ownership of the property if the current owner has abandoned the property or does not wish to pay the remaining taxes.

While the certificates for most properties are bought by a tax buyer, there are a certain segment of properties in the County where, due to a myriad of factors (such as the location of the property, amount of taxes due, condition of the building, etc.), there are a lack of entities willing to purchase the taxes on the property. When that happens for several years, that specific parcel will go to what is called the Cook County Scavenger Sale. The Scavenger Sale, conducted every two (2) years, consist of parcels of land where the taxes have been delinquent for three (3) or more years, and are thereby considered forfeited. The sale is conducted by the Cook County Treasurer’s Office, and more background information can be found here. Additional information on the policies and procedures of the sale can be found here.

IMPORTANT PROCEDURAL INFO REGARDING TAX CERTIFICATE LOTS

- If the vacant lot is located within the City of Chicago and you currently reside outside of the ward you are attempting to purchase the lot, you may be required to provide a letter of support from that local alderman to supplement your application. In the same vein, if you live outside of the suburban municipality you are looking to acquire property, you may be required to provide a letter of support from the municipality as well. It is not required at the time of the application(s), and further instructions will be given upon completion of the application(s).

- If awarded a parcel, you must abide by all regulations and laws within that local jurisdiction. Within the City of Chicago, for instance, you must abide by the City’s Zoning Ordinance regarding permissible uses. You must also abide by the following rules and regulations concerning:

- Regarding the timeline, once an agreement is reached it can take up to nine (9) months for the Land Bank to acquire the property. This is due to the fact that the CCLBA does not currently own this property and needs to perform additional steps in order to take this property/parcel to deed.

- For each successful application, you will be required to sign a terms sheet, which will outline the terms and conditions for acquiring the parcel. For vacant lots, a $500.00 non-refundable deposit will be required, which will count as a credit towards closing contingent on the sale of the parcel.

- A $1,000 forgivable mortgage will be placed on the parcel(s) at the time of closing. The forgivable mortgage is to ensure that the purchaser maintains the property in compliance with all local building and property maintenance codes and hold title throughout the mortgage term. The mortgage will be be automatically released after thirty-six (36) months if all conditions have been satisfied.

- All outstanding and delinquent taxes will be forgiven on these parcels up until the time that the property is conveyed, and the new owner will be responsible for the property taxes on a go forward basis. Due to the tax code, if you are the current owner and/or associated with the current owner of a particular property, you are ineligible to apply for that property.